What Is a TIN ID?

TIN stands for Taxpayer Identification Number. A TIN ID, also known as a TIN card, is a form of identification that includes the holder's BIR (Bureau of Internal Revenue) TIN number, complete name, address, passport-size photo, signature, date of birth, and issue date.

The BIR provides the card for free, and the best part is that the card does not expire. Every patriotic Filipino citizen who is tax-compliant, whether employed, self-employed, or unemployed, can obtain a Tax Identification Number.

What Are The Requirements For TIN ID?

Depending on the applicant's job position, the Bureau of Internal Revenue (BIR) requires distinct sets of conditions for the TIN application. The following are the TIN ID requirements for employee application documents, according to the BIR official website.

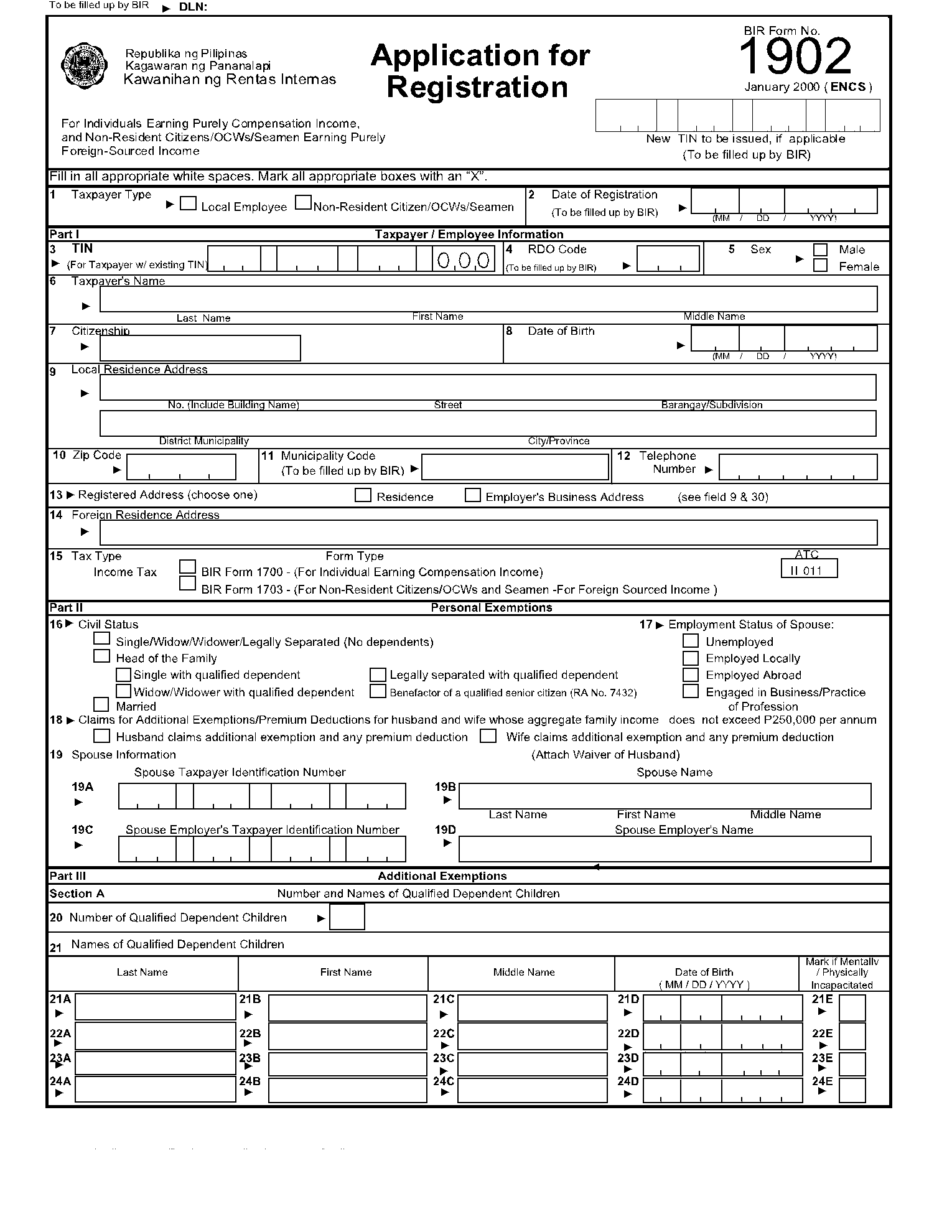

- BIR Form 1902

- Identification documents such as a birth certificate, passport, LTO driver's license, or community tax certificate.

- Marriage contract for married women

- Passport for foreigners

Where Can I Get My TIN?

Since everyone must pay their tax, then everyone must have a TIN.

Unfortunately, it is impossible to get your TIN ID from any BIR branch.

In the Philippines, each taxpayer is assigned to a single Revenue District Office (RDO) responsible for their home or business location. You can pay taxes, amend the information, and obtain or change TIN IDs at your assigned RDO. This means you must obtain your TIN from your RDO.

Who Can Get a TIN ID?

Anyone who earns money in the Philippines, both Filipinos and foreigners, is obligated to pay taxes to the government and must register with the BIR and obtain a tax identification number (TIN).

Non-taxpayers may be compelled to obtain a TIN in certain circumstances under Executive Order (EO) 98. They deal with the government to get licenses, permits, or other official documents, or with financial organizations like banks and stockbrokers to open savings, checking, or investment accounts.

Here’s a list of individuals/businesses that can apply for a TIN ID if they’ve never gotten one:

- Those who are self-employed (whether local or foreign, including freelancers, online sellers, sole proprietors, and professionals)

- Employees who earn money on the side as a freelancer, entrepreneurs, and professionals (commonly known as mixed-income earners).

- Estates (whether local or foreign)

- Trusts (whether local or foreign)

- Employees in the Philippines (whether local or foreign)

- Corporate taxpayers

- Persons registering under EO 98 to be able to transact with other government offices (including unemployed Filipinos who are tax-exempt)

- One-time taxpayers

How to Get Your TIN ID?

Getting your TIN ID often differs if you are employed or unemployed. This section will show you how you can get your ID if you fall under either category.

How to Get TIN ID for New Employees?

The HR department is normally in charge of processing TIN ID applications for new workers.

Here are the steps on how to get your TIN ID for new employees.

- Fill out the BIR Form 1902 and submit the required documents to your HR.

- Your application will be processed by HR. Simply wait a few days for your card to arrive.

- If your employer asked you to process your TIN application on your own, go to the RDO where your business is registered and present all necessary documents. Your identification will be processed the same day.

How to Get TIN ID if You’re Unemployed?

Executive Order No. 98 allows students and unemployed Filipinos over 18 to obtain a TIN ID. The TIN ID is now required to transact with other government offices under this EO.

For unemployed people and students, the TIN ID requirements are as follows:

- Any identification document issued by an authorized government authority, such as a birth certificate, driver's license, passport, or Community Tax Certificate.

- Passport (for non-resident aliens)

- Marriage Contract (for married women)

Once you've gathered these documents, just follow these instructions to obtain your TIN ID:

- Fill out the BIR Form 1904[4] and bring your documents (mainly your birth certificate) to the RDO of the city you’re residing in.

- Submit the documents to the authorized personnel.

- Once your application is processed, wait for the issuance date of your TIN ID.

How to Get a TIN ID online?

Most government operations have been simplified and made more accessible to individuals thanks to the internet. The TIN online registration is one such service. The procedure for obtaining a TIN online is simple and convenient for the applicant.

You can access the online application for the document through the BIR eReg web application system. You can apply at any Bureau of Internal Revenue branch office without having to present in person.

External Resources

https://www.irs.gov/individuals/international-taxpayers/taxpayer-identification-numbers-tin